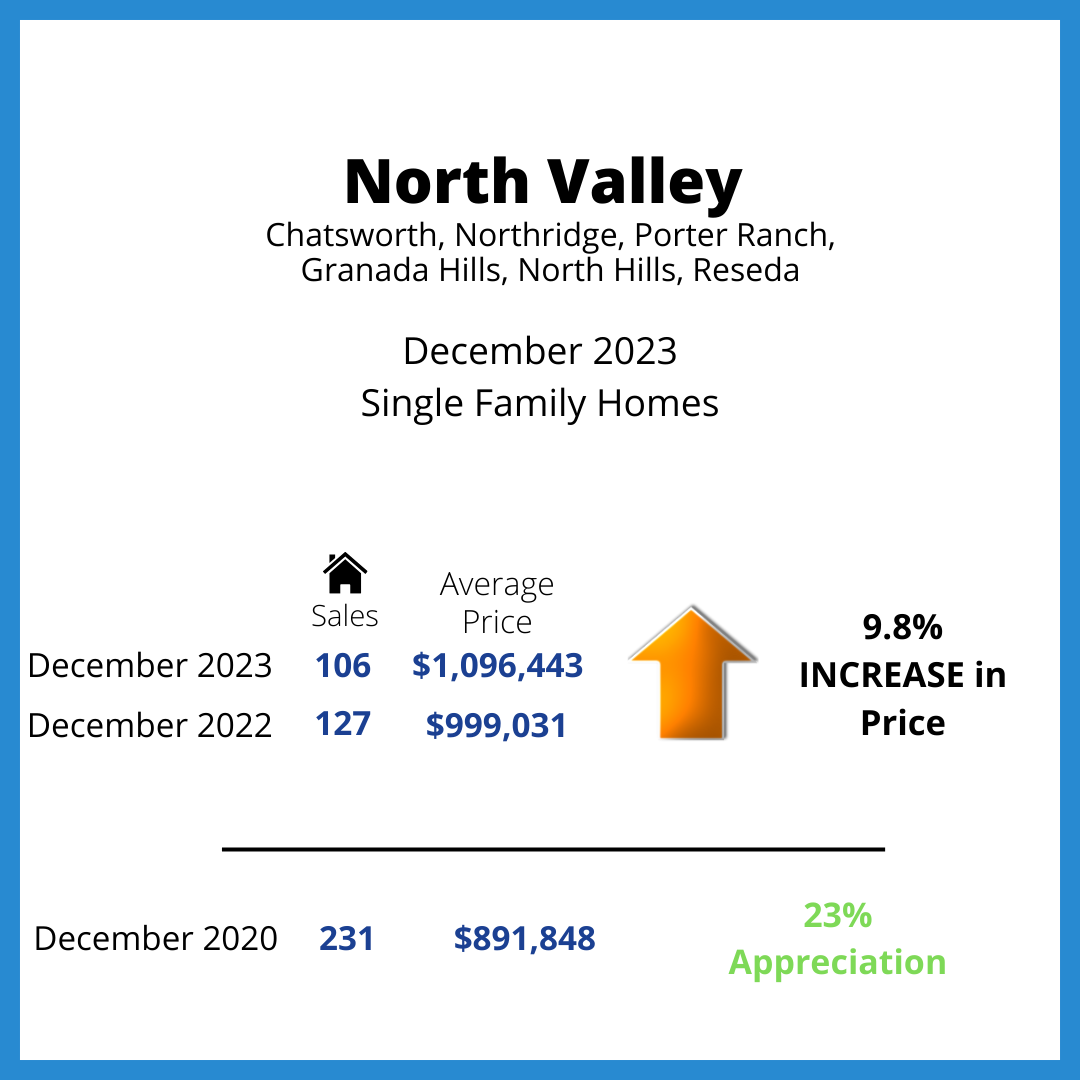

The trend of limited supply continued to dominate the market and higher interest rates had a slight cooling effect for the last quarter of 2023. In the past few months we have seen interest rates at their highest in years (over 8%). The Federal Reserve recently indicated they are done raising rates and that inflation indications are looking better, this resulted in rates dropping in December and ending the year around 6.5%. The combination of higher interest rates and the holiday season resulted in flat sales and prices for the end of the year.

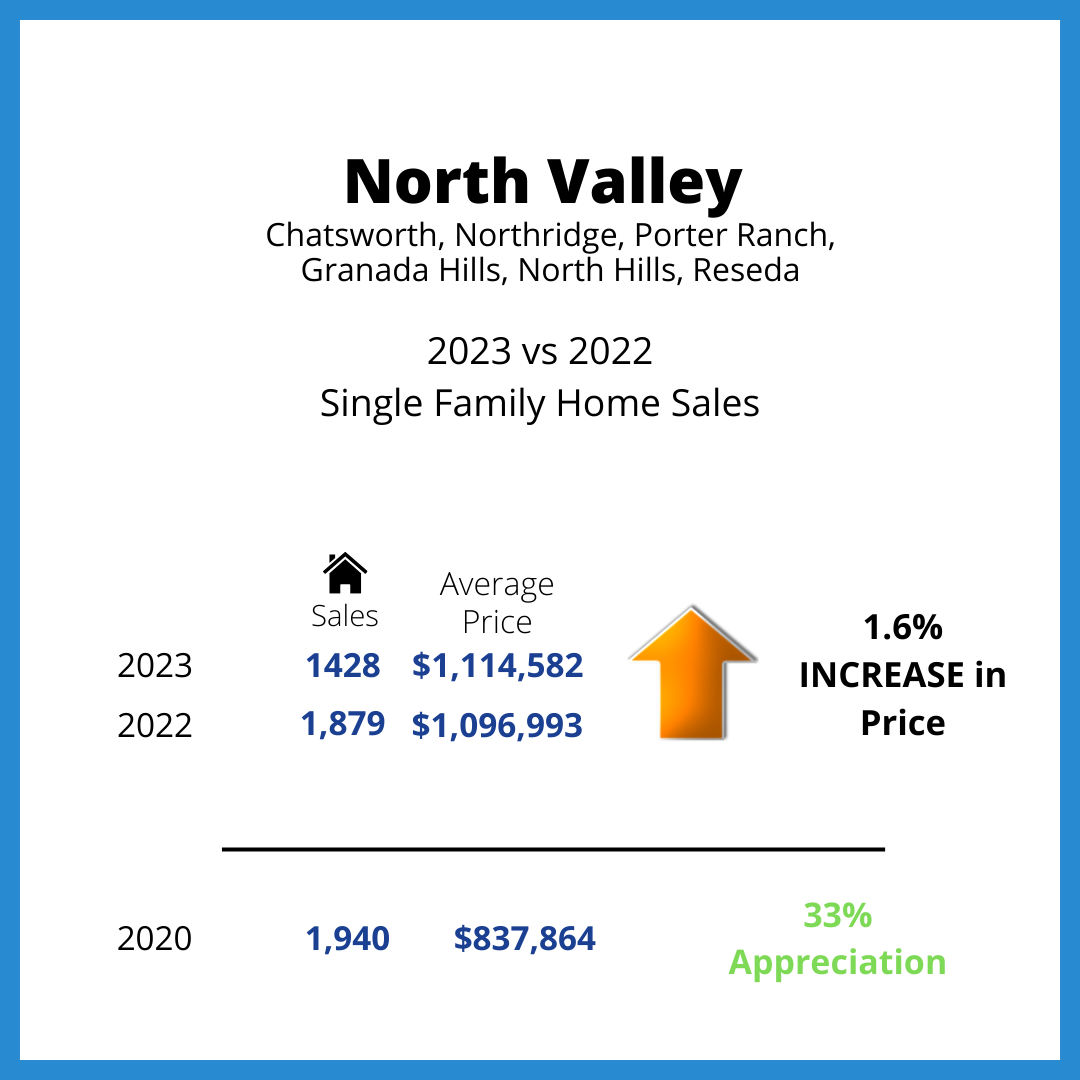

On a positive note, home values continue to appreciate significantly over the past three years. If you’ve owned your home for several years or more, you are in a favorable position if you’re thinking about selling. It is expected that a significant increase in housing inventory may occur when interest rates begin to decrease, which could impact pricing, so do not delay in listing your home.

In the North and West Valley, prices have risen considerably compared to the same time in 2022. Overall sales prices for 2022 vs. 2023 have remained relatively flat. It is anticipated, that as interest rates come down this year (as predicted), then we will see an increase in buying power as well as activity.

Ultimately, pricing will always be influenced by factors such as the property’s condition, recent sales in the area, and the willingness of prospective buyers to pay for a similar home. If you would like to explore your options or delve deeper into this topic, please don’t hesitate to reach out to me via phone or email.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link